Bear Creek initiated the Mercedes operations improvement program shortly after acquiring the property in April 2022. It included a GAP analysis to identify potential improvements in mine planning, operating efficiencies and equipment utilization, with a targeted minimum production of 70,000 gold ounces per year.

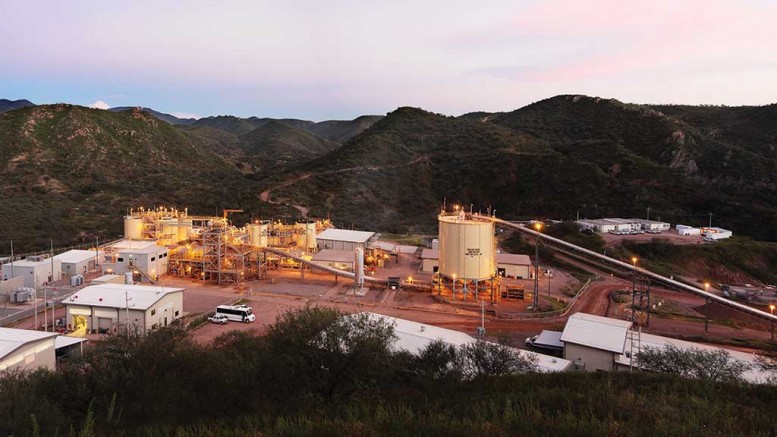

Located in the northwestern edge of Mexico’s epithermal gold and silver deposits belt, the Mercedes mine consists of six known main deposits. Since entering commercial production in 2011, the mine operated primarily from the Diluvio and Lupita zones.

Under Bear Creek’s ownership, mine planning and development at Mercedes is now shifting toward higher-grade deposits utilizing cut and fill mining methods, which is expected to support increased production during 2023.

As infrastructure development in previously shutdown operations returns to safe levels, they will be brought back into production and are expected to “significantly increase” mill feed grade, the company said.

The Marianas and San Martin deposits began contributing to Mercedes’ production in late January and will become larger contributors as working areas continue to be developed. Ore from Rey de Oro should be delivered to the mill in March.

According to Bear Creek, the addition of ore from these deposits will improve the overall grade profile as the year progresses such that during the second half of 2023, Mercedes will be operating at an annualized 74,000-86,000 ounces of gold production at all in sustaining costs of about $1,000 per ounce.

“Our expectation is for a 49% increase in gold production this year, relative to 2022, driven by mine development work we conducted in 2022 and are continuing this year,” stated Eric Caba, president and COO of Bear Creek.

“Improvements in mine production, dilution control and maintenance are being realized and approaching targeted levels; thereby creating confidence that we will realize the potential of Mercedes,” he added.

THE FIRST E-COMMERCE SPECIALIZED ON TRUFFLES AND TRUFFLE PRODUCTS – TRUFFLEAT.IT