Iain Davis

Central bank digital currency (CBDC) will end human freedom. Don’t fall for the assurances of safeguards, the promises of anonymity and of data protection. They are all deceptions and diversions to obscure the malevolent intent behind the global rollout of CBDC.

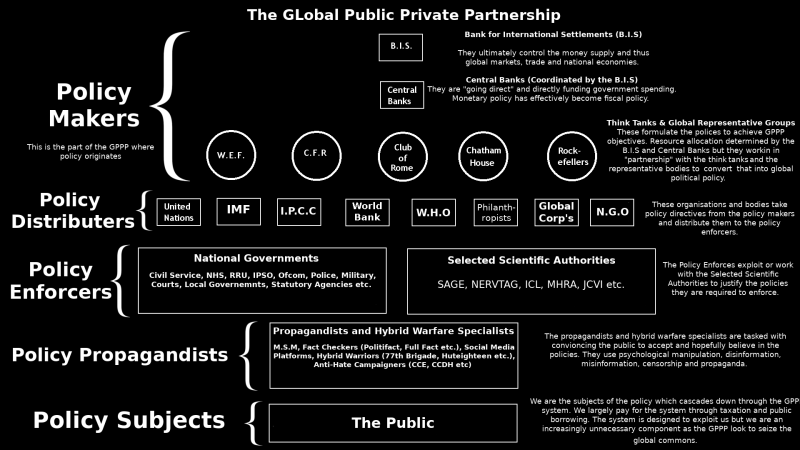

Central Bank Digital Currency is the most comprehensive, far-reaching, authoritarian social control mechanism ever devised. Its “interoperability” will enable the CBDCs issued by various national central banks to be networked to form one, centralised global CBDC surveillance and control system.

Should we allow it to prevail, CBDC will deliver the global governance of humanity into the hands of the bankers.

CBDC is unlike any kind of “money” with which we are familiar. It is programmable and “smart contracts” can be written into its code to control the terms and conditions of the transaction.

Policy decisions and broader policy agendas, restricting our lives as desired, can be enforced using CBDC without any need of legislation. Democratic accountability, already a farcical concept, will become literally meaningless.

CBDC will enable genuinely unprecedented levels of surveillance, as every transaction we make will be monitored and controlled. Not just the products, goods and services we buy, even the transactions we make with each other will be overseen by the central bankers of the global governance state. Data gathering will expand to encompass every aspect of our lives.

This will allow central planners to engineer society precisely as the bankers wish. CBDC can and will be linked to our Digital IDs and, through our CBDC “wallets,” tied to our individual carbon credit accounts and jab certificates. CBDC will limit our freedom to roam and enable our programmers to adjust our behaviour if we stray from our designated Technate function.

The purpose of CBDC is to establish the tyranny of a dictatorship. If we allow CBDC to become our only means of monetary exchange, it will be used enslave us.

Be under no illusions: CBDC is the endgame.

What Is Money?

Defining “money” isn’t difficult, although economists and bankers like to give the impression that it is. Money can simply be defined as:

A commodity accepted by general consent as a medium of economic exchange. It is the medium in which prices and values are expressed. It circulates from person to person and country to country, facilitating trade, and it is the principal measure of wealth.

Money is a “medium”—a paper note, a coin, a casino chip, a gold nugget or a digital token, etc.—that we agree to use in exchange transactions. It is worth whatever value we ascribe to it and it is the agreed value which makes it possible for us to use it to trade with one-another. If its value is socially accepted “by general consent” we can use it to buy goods and services in the wider economy.

We could use anything we like as money and we are perfectly capable of managing a monetary system voluntarily. The famous example of US prisoners using tins of mackerel as money illustrates both how money functions and how it can be manipulated by the “authorities” if they control the issuance of it.

Tins of mackerel are small and robust and can serve as perfect exchange tokens (currency) that are easy to carry and store. When smoking was banned within the US penal system, the prisoners preferred currency, the cigarette, was instantly taken out of circulation. As there was a steady, controlled supply of mackerel cans, with each prisoners allotted a maximum of 14 per week, the prisoners agreed to use the tinned fish as a “medium of economic exchange” instead.

The prisoners called in-date tins the EMAK (edible mackerel) as this had “intrinsic” utility value as food. Out-of-date fish didn’t, but was still valued solely as a medium of exchange. The inmates created an exchange rate of 4 inedible MMAKs (money mackerel) to three EMAKs.

You could buy goods and services in the Inmate Run Market (IRM) that were not available on the Administration Run Market (ARM). Other prison populations adopted the same monetary system, thus enabling inmates to store value in the form of MAKs. They could use their saved MAKs in other prisons if they were transferred.

Prisoners would accept payment in MAKs for cooking pizza, mending clothes, cleaning cells, etc. These inmate service providers were effectively operating IRM businesses. The prisoners had voluntarily constructed a functioning economy and monetary system.

Their main problem was that they were reliant upon a monetary policy authority—the US prison administration—who issued their currency (MAKs). This was done at a constant inflationary rate (14 tins per prisoner per week) meaning that the inflationary devaluation of the MAKs was initially constant and therefore stable.

It isn’t clear if it was deliberate, but the prison authorities eventually left large quantities of EMAKs and MMAKs in communal areas, thereby vastly increasing the money supply. This destabilised the MAK, causing hyperinflation that destroyed its value.

With a glut of MAKs available, its purchasing power collapsed. Massive quantities were needed to buy a haircut, for example, thus rendering the IRM economy physically and economically impractical. If only temporarily.

The Bankers’ Nightmare

In June 2022, as part of its annual report, the BIS published The future monetary system. The central banks (BIS members) effectively highlighted their concerns about the potential for the decentralised finance (DeFi), common to the “crypto universe,” to undermine their authority as the issuers of “money”:

[DeFi] seeks to replicate conventional financial services within the crypto universe. These services are enabled by innovations such as programmability and composability on permissionless blockchains.

The BIS defined DeFi as:

[. . .] a set of activities across financial services built on permissionless DLT [Distributed Ledger Technology] such as blockchains.

The key issue for the central bankers was “permissionless.”

A blockchain is one type of DLT that can either be permissionless or permissioned. Many of the most well known cryptocurrencies are based upon “permissionless” blockchains. The permissionless blockchain has no access control.

Both the users and the “nodes” that validate the transactions on the permissionless blockchain network are anonymous. The network distributed nodes perform cryptographic check-sums to validate transactions, each seeking to enter the next block in the chain in return for an issuance of cryptocurrency (mining). This means that the anonymous—if they wish–users of the cryptocurrency can be confident that transactions have been recorded and validated without any need of a bank.

Regardless of what you think about cryptocurrency, it is not the innumerable coins and models of “money” in the “crypto universe” that concerns the BIS or its central bank member. It is the underpinning “permissionless” DLT, threatening their ability to maintain financial and economic control, that preoccupies them.

The BIS more-or-less admits this:

Crypto has its origin in Bitcoin, which introduced a radical idea: a decentralised means of transferring value on a permissionless blockchain. Any participant can act as a validating node and take part in the validation of transactions on a public ledger (ie the permissionless blockchain). Rather than relying on trusted intermediaries (such as banks), record-keeping on the blockchain is performed by a multitude of anonymous, self-interested validators.

Many will argue that Bitcoin was a creation of the deep state. Perhaps to lay the foundation for CBDC, or at least provide the claimed justification for it. Although the fact that this is one “conspiracy theory” that the mainstream media is willing to entertain might give us pause for thought.

Interesting though this debate may be, it is an aside because it is not Bitcoin, nor any other cryptoasset constructed upon any permissionless DLT, that threatens human freedom. The proposed models of CBDC most certainly do.

CBDC & The End of the Split Circuit IMFS

Central banks are private corporations just as commercial banks are. As we bank with commercial banks so commercial banks bank with central banks. We are told that central banks have something to do with government, but that is a myth.

Today, we use “fiat currency” as money. Commercial banks create this “money” out of thin air when they make a loan (exposed here). In exchange for a loan agreement the commercial bank creates a corresponding “bank deposit”—from nothing—that the customer can then access as new money. This money (fiat currency) exists as commercial bank deposit and can be called “broad money.”

Commercial banks hold reserve accounts with the central banks. These operate using a different type of fiat currency called “central bank reserves” or “base money.”

We cannot exchange “base money,” nor can “nonbank” businesses. Only commercial and central banks have access to base money. This creates, what John Titus describes—on his excellent Best Evidence Channel—as the split-monetary circuit.

Prior to the pseudopandemic, in theory, base money did not “leak” into the broad money circuit. Instead, increasing commercial banks’ “reserves” supposedly encouraged them to lend more and thereby allegedly increase economic activity through some vague mechanism called “stimulus” .

Following the global financial crash in 2008, which was caused by the commercial banks profligate speculation on worthless financial derivatives, the central banks “bailed-out” the bankrupt commercial banks by buying their worthless assets (securities) with base money. The new base money, also created from nothing, remained accessible only to the commercial banks. The new base money didn’t directly create new broad money.

This all changed, thanks to a plan presented to central banks by the global investment firm BlackRock. In late 2019, the G7 central bankers endorsed BlackRock’s suggested “going-direct” monetary strategy.

BlackRock said that the monetary conditions that prevailed as a result of the bank bail-outs had left the International Monetary and Financial System (IMFS) “tapped out.” Therefore, BlackRock suggested that a new approach would be needed in the next downturn if “unusual circumstances” arose.

These circumstances would warrant “unconventional monetary policy and unprecedented policy coordination.” BlackRock opined:

Going direct means the central bank finding ways to get central bank money directly in the hands of public and private sector spenders.

Coincidentally, just a couple of months later, the precise “unusual circumstances,” specified by BlackRock, came about as an alleged consequence of the pseudopandemic. The “going direct” plan was implemented.

Instead of using “base money” to buy worthless assets solely from commercial banks, the central banks used the base money to create “broad money” deposits in commercial banks. The commercial banks acted as passive intermediaries, effectively enabling the central banks to buy assets from nonbanks. These nonbank private corporations and financial institutions would have otherwise been unable sell their bonds and other securities directly to the central banks because they can’t trade using central bank base money.

The US Federal Reserve (Fed) explain how they deployed BlackRock’s ‘going direct’ plan:

A notable development in the U.S. banking system following the onset of the COVID-19 pandemic has been the rapid and sustained growth in aggregate bank deposits [broad money]. [. . .] When the Federal Reserve purchases securities from a nonbank seller, it creates new bank deposits by crediting the reserve account of the depository institution [base money] at which the nonbank seller has an account, and then the depository institution credits the deposit [broad money] account of the nonbank seller.

This process of central banks issuing “currency” that then finds its way directly into private hands will find its ultimate expression through CBDC. The transformation of the IMFS, suggested by BlackRock’s “going direct” plan, effectively served as a forerunner for the proposed CBDC based IMFS.

The “Essential” CBDC Public-Private Partnerships

CBDC will only be “issued” by the central banks. All CBDC is “base money.” It will end the traditional split circuit monetary system, although proponents of CBDC like to pretend that it won’t, claiming the “two-tier banking system” will continue.

This is nonsense. The new “two-tier” CBDC system is nothing like its more distant predecessor and much more like “going direct.”.

CBDC potentially cuts commercial banks out of the “creating money from nothing” scam. The need for some quid pro quo between the central and the commercial banks was highlighted in a recent report by McKinsey & Company:

The successful launch of a CBDC involving direct consumer and business accounts could displace a material share of deposits currently held in commercial bank accounts and could create a new competitive front for payment solution providers.

McKinsey also noted, for CBDC to be successful, it would need to be widely adopted:

Ultimately, the success of CBDC launches will be measured by user adoption, which in turn will be tied to the digital coins’ acceptance as a payment method with a value proposition that improves on existing alternatives. [. . .] To be successful, CBDCs will need to gain substantial usage, partially displacing other instruments of payment and value storage.

According to McKinsey, a thriving CBDC would need to replace existing “instruments of payment.” To achieve this, the private “payment solution providers” will have to be on-board. So, if they are going to countenance displacement of their “material share of deposits,” commercial banks need an incentive.

Whatever model CBDC ultimately takes, if the central bankers want to minimise commercial resistance from “existing alternatives,” so-called public-private partnership with the commercial banks is essential. Though, seeing as central banks are also private corporations, perhaps “corporate-private partnership” would be more appropriate.

McKinsey state:

Commercial banks will likely play a key role in large-scale CBDC rollouts, given their capabilities and knowledge of customer needs and habits. Commercial banks have the deepest capabilities in client onboarding [adoption of CBDC payment systems] [. . .] so it seems likely that the success of a CBDC model will depend on a public–private partnership (PPP) between commercial and central banks.

Accenture, the global IT consultancy that is a founding member of the ID2020 Alliance global digital identity partnership, agrees with McKinsey.

Make no mistake: Commercial banks have a pivotal role to play and a unique opportunity to shape the course of CBDC at its foundation. [. . .] CBDC is developing at a much faster pace than that of other payment systems. [. . .] In the U.S. at least, the design of a CBDC will likely involve the private sector, and with the two-tier banking system set to remain in place, commercial banks must now step up and forge a path forward.

What Model of CBDC?

By creating the new concept of “wholesale CBDC,” the two-tier fallacy can be maintained by those who think this matters. Nonetheless, it is true that a wholesale CBDC wouldn’t necessarily supplant broad money.

The Bank for International Settlements (BIS)—the central bank for central banks—offers a definition of the wholesale CBDC variant:

Wholesale CBDCs are for use by regulated financial institutions. They build on the current two-tier structure, which places the central bank at the foundation of the payment system while assigning customer-facing activities to PSPs [non-bank payment service providers]. The central bank grants accounts to commercial banks and other PSPs, and domestic payments are settled on the central bank’s balance sheet. [. . .] Wholesale CBDCs and central bank reserves operate in a very similar way.

Wholesale CBDC has some tenuous similarities to the current central bank reserve system but, depending upon the added functionality of the CBDC design, increases central bank ability to control all investment and subsequent business activity. This alone could have an immense social impact.

The BIS continues:

[. . .] a more far-reaching innovation is the introduction of retail CBDCs. Retail CBDCs modify the conventional two-tier monetary system in that they make central bank digital money available to the general public, just as cash is available to the general public as a direct claim on the central bank. [. . .] A retail CBDC is akin to a digital form of cash[.] [. . .] Retail CBDCs come in two variants. One option makes for a cash-like design, allowing for so-called token-based access and anonymity in payments. This option would give individual users access to the CBDC based on a password-like digital signature using private-public key cryptography, without requiring personal identification. The other approach is built on verifying users’ identity (“account-based access”) and would be rooted in a digital identity scheme.

It is “retail CBDC” that extends central bank oversight and enables it to govern every aspect of our lives. Retail CBDC is the ultimate nightmare scenario for us as individual “citizens.”

While the BIS outlines the basic concept of retail CBDC, it has thoroughly misled the public. Suggesting that retail CBDC is the users “claim on the central bank” sounds much better than acknowledging that CBDC is a liability of the central bank. That is, the central bank always “owns” the CBDC.

It is a liability which, as we shall see, the central bank agrees to pay if its stipulated “smart contract” conditions are met. A retail CBDC is actually the central bank’s “claim” on whatever is in your CBDC “wallet.”

The BIS assertion, that CBDC is “akin to a digital form of cash,” is a lie. CBDC is nothing like “cash,” save in the remotest possible sense.

Both cash, as we understand it, and CBDC are liabilities of the central bank but the comparison ends there. The central bank, or its commercial bank “partners,” cannot monitor where we exchange cash nor control what we buy with it. CBDC will empower them to do both.

At the moment, spending cash in a retail setting—-without biometric surveillance such as facial recognition cameras—is automatically anonymous. While “token-based access” retail CBDC could theoretically maintain our anonymity, this is irrelevant because we are all being herded into a retail CBDC design that is “rooted in a digital identity scheme.”

The UK central bank—the Bank of England (BoE)—has recently published its envisaged technical specification for its CBDC which it deceptively calls the Digital Pound. The BoE categorically states:

CBDC would not be anonymous because the ability to identify and verify users is needed to prevent financial crime and to meet applicable legal and regulatory obligations. [. . .] Varying levels of identification would be accepted to ensure that CBDC is available for all. [. . . ] Users should be able to vary their privacy preferences to suit their privacy needs within the parameters set by law, the Bank and the Government. Enhanced privacy functionality could result in users securing greater benefits from sharing their personal data.

Again, it is imperative to appreciate that CBDC is nothing like cash. Cash may be preferred by “criminals” but it is more widely preferred by people who do not want to share all their personal data simply to conduct business or buy goods and services.

The Digital Pound will end that possibility for British people. Just as CBDCs in every other country will end it for their populations.

The BoE model assumes no possible escape route. Even for those unable to present state approved “papers” on demand, “varying levels of identification” will be enforced to ensure that the CBDC control grid is “for all.” The BoE, the executive branch of government and the judiciary form a partnership that will determine the acceptable “parameters” of the BoE’s, not the users, “privacy preferences.”

The more personal identification data you share with the BoE and its state partners, the sweeter your permitted use of CBDC will be. It all depends upon your willingness to comply. Failure to comply will result in you being unable to function as a citizen and ensure that you are effectively barred from mainstream society.

If we simply concede to the rollout of the CBDC, the concept of the free human being will be distant memory. Only the first couple of post CBDC generations will have any appreciation of what happened. If they don’t deal with it, the future CBDC slavery of humanity will be inescapable.

This may sound like hyperbole but, regrettably, it isn’t. It is the dictatorial nightmare of retail CBDC that we will explore in part 2, alongside the simple steps we can all take to ensure the CBDC nightmare never becomes a reality.